From 1 July 2021, tourism tax will be levied on a tourist staying at any accommodation premises booked online through a digital platform service provider. The order has been gazetted on 16th March 2021.

Wednesday, 24 March 2021

Tourists to pay tax on accommodations booked online

Monday, 14 December 2020

Build firm resilience with predictive intelligence

If

2020 has taught us anything, it’s that the future is full of unexpected

surprises. But what if you could predict the future? Although there are still

many unknowns, predictive intelligence can help you build resilience by

proactively identifying how tax legislation or regulatory changes could affect

your clients. Advanced technologies, like CCH iQ Client Match can help firms

provide enhanced client service and deliver business insights that

help streamline tax season and discover additional revenue streams.

Provide

year-round superior client service

If

you want clients to view you as advisors rather than just accountants, you need

to anticipate their needs before they even ask you for help. Because if you

don’t, you could lose their business. Up to 72% of small businesses have changed

accounting firms because the firm wasn’t proactive about addressing tax law

changes. With predictive intelligence, your firm can offer updates all year

long on how regulatory changes might affect them, so clients can take action

today.

Create an efficient tax season

With

growing financial advisory services, your firm is keeping in touch with clients

all year long, delivering important business insights proactively. But did you

know that predictive intelligence also can save critical time during your busy

season? With CCH iQ Client Match your firm can streamline the tax prep and

review process by identifying which legislative changes could affect each client.

This gives you a heads up for areas of the tax return that may require a bit of

extra attention.

Discover new revenue sources

You

can use the power of predictive intelligence to flip your firm’s mix of

business from primarily commoditised compliance services to a higher percentage

of lucrative advisory services. Position your firm as a trusted partner and

open up additional revenue streams.

Tuesday, 17 December 2019

Budget 2020

Budget 2020 Higlights:-

Content Management Analyst

Wolters Kluwer Malaysia

Monday, 2 December 2019

More Sales Tax Hikes Needed from Japan, IMF Says

Japan's headline consumption tax rate was increased from eight percent to 10 percent on October 1, 2019. A reduced eight percent applies to the supply of foods and drinks – with the exception of liquors and restaurant services – and to subscription newspapers issued twice or more a week.

The consumption tax rate was last increased in 2014, when it rose from five percent to eight percent.

The IMF said that, relative to 2014, consumption has been less affected by October's rate hike, owing partly to countermeasures introduced by the Government. These measures include a tax allowance for automobile and house purchases, a point-reward program for cashless payments in SMEs, infrastructure investment, and additional spending for childcare and tertiary education.

Friday, 8 November 2019

Tax Deductibility of Valuation Fee

Tuesday, 8 October 2019

Transfer Pricing Dispute Successfully Resolved

In FSB vs Ketua Pengarah Hasil Dalam Negeri, a transfer pricing appeal before the DGIR made transfer pricing adjustments on the ground that services

provided by the holding company were duplicative of the

activities carried out by the taxpayer. The DGIR invoked Section

140(1) of the Income Tax Act 1967 and applied the general tax

avoidance provision to perform transfer pricing adjustments.

Tax assessments were raised and the taxpayer appealed

against the assessments to the SCIT.

In FSB vs Ketua Pengarah Hasil Dalam Negeri, a transfer pricing appeal before the DGIR made transfer pricing adjustments on the ground that services

provided by the holding company were duplicative of the

activities carried out by the taxpayer. The DGIR invoked Section

140(1) of the Income Tax Act 1967 and applied the general tax

avoidance provision to perform transfer pricing adjustments.

Tax assessments were raised and the taxpayer appealed

against the assessments to the SCIT.

Tuesday, 23 July 2019

Case Spotlight: Tariff Classification for Sales Tax

The reintroduction of sales tax highlights the need to be precise

in the tariff classification of goods manufactured in or imported

into Malaysia. Under the goods and services tax (GST) regime,

a standard rate of 6% duty was imposed on all taxable goods

(except for exempt and zero-rated supplies). However, under

the sales tax regime, goods can be either exempted (0%) from

sales tax or be subject to sales tax of 5%, 10% or 15%. This

sales tax rate differentiation is entirely based on tariff

classification. Tariff classification thus becomes a key aspect in

determining the sales tax rate payable.

The reintroduction of sales tax highlights the need to be precise

in the tariff classification of goods manufactured in or imported

into Malaysia. Under the goods and services tax (GST) regime,

a standard rate of 6% duty was imposed on all taxable goods

(except for exempt and zero-rated supplies). However, under

the sales tax regime, goods can be either exempted (0%) from

sales tax or be subject to sales tax of 5%, 10% or 15%. This

sales tax rate differentiation is entirely based on tariff

classification. Tariff classification thus becomes a key aspect in

determining the sales tax rate payable. The Australian High Court recently granted special leave to the appeal sought by Comptroller General of Customs (Australian Customs) against the Federal Court’s decision in ComptrollerGeneral of Customs v Pharm-A-Care Laboratories [2018] FCAFC 237. This case concerns the tariff classification of vitamin gummies (Vitamin Gummies) and weight loss gummies (Weight Loss Gummies) imported by the taxpayer.

Thursday, 11 July 2019

Case Spotlight: Arbitrary Transfer Pricing Assessments Successfully Set Aside

OSB v Ketua Pengarah Hasil Dalam Negeri

OSB v Ketua Pengarah Hasil Dalam NegeriIn a landmark ruling, the Special Commissioners of Income Tax (SCIT) unanimously allowed a tax appeal against transfer pricing tax assessments raised by the Director General of Inland Revenue (DGIR). The assessments were raised consequent to a transfer pricing audit. Our Tax, SST & Customs lawyers, led by senior partner Datuk D P Naban together with partner S Saravana Kumar, and senior associate Jason Tan Jia Xin, successfully represented OSB.

Tuesday, 25 June 2019

Case Spotlight: Transfer Pricing - DGIR’s Power To Vary Transactions

In the recent Indian case of Pr

Commissioner of Income Tax vs M/S Aegis Ltd (Case No 1248 of 2016), one of the

issues was whether the Indian Revenue Service (IRS) can re-characterise a share

subscription transaction as an advance of unsecured loans. The High Court held

that the IRS is not entitled to do so and dismissed its appeal against the

decision of the Income Tax Appellate Tribunal (Tribunal).

In the recent Indian case of Pr

Commissioner of Income Tax vs M/S Aegis Ltd (Case No 1248 of 2016), one of the

issues was whether the Indian Revenue Service (IRS) can re-characterise a share

subscription transaction as an advance of unsecured loans. The High Court held

that the IRS is not entitled to do so and dismissed its appeal against the

decision of the Income Tax Appellate Tribunal (Tribunal). Monday, 29 April 2019

India needs to rethink attitude towards corporate tax avoidance

This article was first published on the Kluwer International Tax Blog on 8 April 2019.

According to an oft-cited research by the UN University World Institute for Development Economics Research, India loses over 40 billion US dollars in revenue, annually, to corporate tax avoidance. Obviously, for a country like India, the money could have been used to reduce poverty-related deaths and to provide basic social care to the poor and underprivileged. Despite its impact, corporate tax avoidance is one of the lesser debated issues in India.

Multinational tax avoidance has almost never made it to the front pages of popular Indian newspapers and has never been discussed on primetime TV news debates. That corporate tax avoidance is not ‘popular’ with the Indian voters today is also indicated by the fact that not a single question relating to “tax avoidance” or “corporate tax avoidance” was raised in the Sixteenth Lower House of Parliament (2014-2019).

This is not to suggest that nothing has been done so far. I have blogged about some of the changes recently carried out to the Income Tax Act to mirror the OECD’s BEPS recommendations. Also, in 2017, the government introduced a legislative general anti-avoidance rule (GAAR) to disregard aggressive tax planning arrangements and deny tax treaty benefits. Of course, the GAAR came too late in the day and came only after the Supreme Court, in the case of Vodafone, rather bluntly noted that tax benefits cannot be denied in the absence of any explicit anti-abuse rule in the tax law.

These changes, though necessary, are not sufficient to win India’s fight against corporate tax avoidance. A lot needs to change, both at domestic and international levels.

Monday, 22 April 2019

Reforms relating to tax compliance and tax incentives

Tax compliance

Tax incentives

Tuesday, 19 March 2019

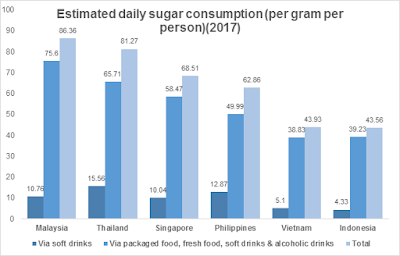

Sugar tax in Malaysia: Sweet idea or bitter pill?

Malaysia’s sweet tooth

Tuesday, 12 February 2019

Evolution of Tax and Investment Incentives in Malaysia

The granting of tax incentives is one of the methods used to develop a

particular economic activity. If designed and implemented properly, it attracts

businesses (local or foreign) to invest in a country. Apart from that, it

should also lead to increased employment, knowledge transfer, technology

development and development to rural areas. Thus, this should lead to increased

economic growth and tax revenue (after the expiration of the tax incentive period).

The granting of tax incentives is one of the methods used to develop a

particular economic activity. If designed and implemented properly, it attracts

businesses (local or foreign) to invest in a country. Apart from that, it

should also lead to increased employment, knowledge transfer, technology

development and development to rural areas. Thus, this should lead to increased

economic growth and tax revenue (after the expiration of the tax incentive period).- Exemption of statutory income

- Additional relief for qualifying capital expenditure

- Double deduction

Tax incentive

|

Description

|

Pioneer Status

|

Companies in the manufacturing, agricultural, hotel, and tourism sectors, or any other industrial or commercial sector that participate in a promoted activity or produce a promoted product may be eligible for the pioneer status incentive.

It involves the granting of a partial exemption (of up to 70% of a company’s statutory income), or in limited cases, full exemption from income tax for a period of five years or 10 years.

|

Investment Tax Allowance

|

Companies in the manufacturing, agricultural, hotel, and tourism sectors, or any other industrial or commercial sector that participate in a promoted activity or produce a promoted product may be eligible for investment tax allowance.

It involves the granting of an allowance of 60% or 100% of qualifying capital expenditure incurred which can be deducted against 70% or 100% of statutory income.

|

Reinvestment Allowance

|

A resident company in operation for not less than 36 months that incurs capital expenditure to expand, modernise, automate, or diversify its existing manufacturing business or approved agricultural project may be eligible for reinvestment allowance.

It involves the granting of an allowance of 60% of qualifying capital expenditure incurred which can be deducted against 70% of statutory income.

|

Tuesday, 15 January 2019

Technically….

Withholding tax: Special classes of income

- including non-technical services, and

- not limiting the scope to technical management or administration of any scientific, industrial or commercial undertaking, venture, project or scheme.

Wednesday, 12 December 2018

Tis’ the season of giving

- Unregistered taxpayers who have not submitted the Income Tax Return Forms (ITRF)/ Petroleum Tax Returns (PTR)/ Real Property Gains Tax Returns (RPGTR) for any YA

- Registered taxpayers who have not submitted ITRF/PTR/RPGTR for any YA

- Taxpayers who have submitted ITRF/PTR/RPGTR but with incorrect declarations

- Stamp duty payers who failed to present stamp-able instruments within a stipulated period of time.

This is not IRB’s first rodeo. In 2016, the Budget 2016 Recalibration proposed for a special consideration on relaxation for penalty on taxpayers who come forward and declare their past years’ income and settled their arrears before 31 December 2016. Following this, the IRB announced the following offers to taxpayers in support of the proposal:

- Reduction of penalty to specified rates for taxpayers who opt for voluntary disclosure of non-compliance, subject to certain requirements.

- Waiver of tax increase for taxpayers who wish to settle in full their income tax, petroleum income tax, real property gains tax or withholding tax areas on or before 15 December 2016.

Employers’ Tax Awareness: Settlement of PTPTN loan on behalf of employees

It was proposed in the

Finance Bill 2019 that a tax deduction be given to employers who help settle PTPTN loans of

their full-time employees, on the condition that employees are not required to

reimburse the amount paid on their behalf. This proposal is aimed at

improving the loan repayment performance and ensuring the sustainability of the

PTPTN programme.

It was proposed in the

Finance Bill 2019 that a tax deduction be given to employers who help settle PTPTN loans of

their full-time employees, on the condition that employees are not required to

reimburse the amount paid on their behalf. This proposal is aimed at

improving the loan repayment performance and ensuring the sustainability of the

PTPTN programme.- Perquisites can be received regularly or casually.

- Perquisites can be received in cash or in kind.

- Perquisites received by the employee can be in respect of an employment contract or be given by the employer or third party voluntarily.

- A perquisite is subject to tax only if it arises in respect of having or exercising an employment.

Tuesday, 13 November 2018

Budget 2019 Highlights (Tax)

- To implement institutional reforms

- To ensure the socio-economic well-being of Malaysians, and

- To foster and entrepreneurial economy.

Corporate income tax

Tax rate for SMEs

Review of group relief

- Companies surrendering losses must be in operation for at least 12 months

- Surrendering of losses is restricted to three consecutive YAs, and

- A company with unutilised investment tax allowance or unabsorbed pioneer losses will not be eligible to claim group relief.

Time limit for carry forward of unabsorbed losses and allowances

Personal income tax

EPF and life insurance premium relief

- The combined relief of RM6,000 for EPF and takaful/life insurance premiums has been split - RM4,000 for EPF and RM3,000 for takaful/life insurance premiums.

- For public servants under the pension scheme, the income tax relief on takaful/ life insurance premiums is given up to RM7,000.

National Education Savings Scheme (SSPN) relief

Investigation of unexplained extraordinary wealth

Indirect tax

Sales tax and service tax

- Service tax exemption on specific B2B transactions between service tax

registrants.

(Effective 1 January 2019) - Imposition of service tax on imported services as follows:

- Services imported by businesses

(Effective 1 January 2019) - Services imported (e.g. downloaded software, music, video and digital advertising) by consumers)

(Effective 1 January 2020) - Introduction of a credit system against sales tax payable for small

manufacturers who do not purchase from registered manufacturers.

(Effective 1 January 2019)

Sugar tax

- Fruit juices and vegetable juices under tariff heading of 20.09, which contains sugar exceeding 12 grams per 100 millilitres, and

- Beverages under tariff heading of 22.02, which contains sugar exceeding 5 grams per 100 millilitres)

Thursday, 8 November 2018

Malaysian Tax Budget Conference 2019

The new government’s maiden budget announced last Friday

indicates that they are trying to balance between being a socialist government

and being pro-business to boost economic growth. They announced a creative host of subsidies, grants and allocation of funds, and utilised tax measures to promote economic growth and well-being.

The new government’s maiden budget announced last Friday

indicates that they are trying to balance between being a socialist government

and being pro-business to boost economic growth. They announced a creative host of subsidies, grants and allocation of funds, and utilised tax measures to promote economic growth and well-being. The government also proposed tax measures to improve social welfare. They widened the scope of donations – Donations to social enterprises are now qualified for deduction. They focused on employee welfare – a 100% deduction for PTPTN payments made by an employer on behalf of its employees and a 200% deduction on remuneration of full-time employees who are either senior citizens or ex-convicts. These deductions, however, are subject to conditions. They government also proposed a stamp duty exemption for first time home-buyers in respect of property valued between RM300,000 and RM1 million, subject to conditions, consistent with their promise of affordable housing.

Thursday, 4 October 2018

Managing transfer pricing risks

- The adequacy and timeliness of the taxpayers' transfer pricing documentation;

- The appropriateness of the taxpayers' transfer pricing methods; and

- The arm's length outcome of the taxpayers' transfer pricing studies.

- The value of related party transactions;

- The performance of the business over time; and

- The likelihood that taxable profits may have been understated by inappropriate transfer pricing.

Wednesday, 3 October 2018

Tax in the digital age

by Laurence Todd & Connor Vance

Introduction

The case for digital tax

- First, that digital companies pay less tax than non-digital companies;

- Second, that digitalisation has fundamentally altered the way value is generated.

One month extension for SST returns and payment of tax

The Royal Malaysian Customs Department (RMCD) has announced a one month extension (until 31 July 2021) for the submission of SST-02 forms an...

-

Authors: Donovan Cheah (Partner) and Adryenne Lim (Legal Executive) (Donovan & Ho) www.dnh.com.my Tales of errant employees are...

-

Recently in Australia, the world's biggest technology, accounting, media and mining companies – from Google, Apple and Microsoft to BH...

-

by Dave Ananth Dave Ananth, Senior Tax Counsel with Stace Hammond Lawyers, is based in Auckland, New Zealand. He is a senior law...