by Dave Ananth

Dave Ananth, Senior Tax Counsel with Stace Hammond Lawyers, is

based in Auckland, New Zealand. He is a senior lawyer, a former Magistrate and advocate

in Malaysia before taking up a position with the Inland Revenue Department in

New Zealand as a Prosecutor. He is an expert in taxation and tax policy. He

also writes extensively on direct and indirect tax issues in Malaysia and New

Zealand. He is a consultant for Wolters Kluwer Malaysia. He can be reached at davea@shg.co.nz.

The usage of tax to change “unhealthy behaviour” is not uncommon. Examples

include “sin taxes” on cigarettes and alcohol, tax on high fat food (Denmark)

and a “metabo” law (Japan) which was introduced to overcome obesity through

annual measurement of waist circumference, provision of weight loss classes and

the imposition of fines[1].

Malaysia’s sweet tooth

In August 2018, Damanasara MP Tony Pua floated the idea of a “soda tax”

to kill two birds with one stone – to increase government revenue and encourage

healthy living. A few weeks later, Prime Minister Dr Mahathir Mohamad says the

government is considering implementing a soda tax to encourage healthy living

and reduce sugar consumption as the diabetes rate in Malaysia is very high.

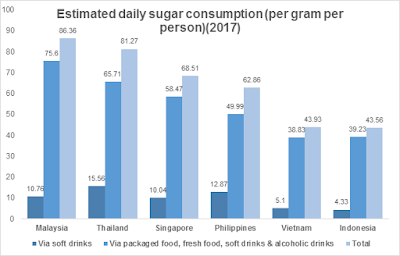

It cannot be denied that Malaysians are eating and

drinking too much sugar. Not just from soft drinks, but from other sweetened

drinks (teh tarik), local kuih (cakes) and biscuits. Per the chart below, the

estimated daily consumption of sugar is the highest among Malaysians[2]

in Southeast Asia (SEA).

It was reported that in 2017, about 16.74% of

adults in Malaysia have diabetes. While it is not the highest in the world

(Malaysia ranks 12), Malaysia still has the highest number of diabetes

sufferers in SEA[3].

It is also worth noting that Malaysia has the highest levels of obesity

sufferers in SEA, at 15.6%. Again, while Malaysia is not the highest in the

world[4],

it is still a cause for concern. Total (direct and indirect) costs of obesity

are highest in Malaysia, amid SEA, where it is estimated to be between 10% and

19% of national healthcare spending[5].

The World Health Organisation (WHO) stated in a report[6]

that sugary drinks are a major contributor to obesity and diabetes, and

suggested that the taxation of sugary drinks can help reduce the consumption of

sugars, just like how the taxation of tobacco helps reduce tobacco use.

In response to Tony’s suggestion, some have opined that it is better to

broaden the tax to include sugar in general, not only soda. Dr Ahmed Razman

Abdul Latiff of University Putra Malaysia questioned whether it is soda or

sugar that is the main contributor of diabetes in Malaysia. He said if the soda

tax implementation is geared towards reducing consumption of excess sugar, it

may be more effective to implement a tax on sugar. In New Zealand, Sir Michael

Cullen appeared to favour a broad-based excise on sugar rather than explicitly

taxing the sugar content of "fizzy drinks" as that would act as a

poorly targeted tax on low income households[7].

Malaysia tries to get a piece of the pie

It was announced in the

Budget 2019 that the Government has decided to impose excise duty on sugar

sweetened beverages at RM0.40 per litre.

It is imposed based on the sugar content as follows:

- Carbonated drinks and non-alcoholic beverages (under tarriff code 22.02) containing added sugars of more than 5gm per 100ml of drink

- Fruit or vegetable juice (under tarriff code 20.09) containing added sugars of more than 12gm per 100ml of drink.

This was supposed to take effect from 1 April

2019. However, it has now been postponed to 1 July 2019 to allow more time for

both manufacturers and the Customs to make preparations[8].

Malaysia will join the

ranks of countries that have implemented various versions of a sugar tax. In

Brunei, BND0.40 (RM1.21) per litre is imposed on

beverages with 6g sugar per 100ml. In Philippines, drinks with caloric and non-caloric

sweeteners is taxed ₱6.00 (RM0.47) per liter while drinks with high-fructose

corn syrup is taxed at ₱12.00 (RM0.94) per liter. Thailand introduced a new

excise tax system, along with new higher tax rates for sugary drinks that will

go up gradually over a six-year period. Currently, carbonated soft drinks will

be taxed [between 0.10 baht (RM0.013) to 1 baht (RM0.13)] per liter according

to sugar content per 100 ml. In UK, a soft drinks industry levy is imposed at

18p (RM0.96) per liter on drinks with 5g-8g sugar per 100ml and 24p (RM1.27)

per liter on drinks with 8g or more sugar per 100ml.

That’s the way the cookie crumbles – increased prices and a sense of injustice

Any increase or introduction of taxes will have an impact on the public

at large, some more than the others. The sugar tax will see the prices of

drinks increase, should companies choose to pass on the cost, which it usually

does. Obesity and obesity-related

diseases are generally suffered by lower socioeconomic groups[9],

and it is understandable that sugar tax advocates would want to ease the

financial and emotional burdens related to illness. However, this means a sugar tax will mainly affect the poor. No matter which way you cut it, a sugar tax

is regressive: people on lower incomes will pay disproportionately more of the

tax than people on higher incomes. A sugar tax is, therefore, punitive and counter-intuitive way to address

the problem: make poor people poorer because it is for their own good[10].

It is also worth noting that sugar is

addictive, as they trigger the release of dopamine (a “feel-good hormone”). If

the public is forced to cut down on their sugary drinks due to the tax, they

might downshift to

cheaper brands with worse artificial sugar content. Switching from Coca-Cola to

air sirap (a local Malaysian drink) will cost less but have no health benefits.

It is also possible that they just shift to salt (another

component that triggers the release of dopamine) as a coping mechanism. The

effect of the tax on health may be smaller if people reduce their sugar intake

but increase their consumption of crisps[11].

If sugar tax advocates

ignore the reasons that lead to the consumption of sugar, they ignore the very

reason people might not act the way advocates want them to.

For those who cannot afford other material

luxuries, food may be one of the few luxuries a family can indulge in. For another,

it is a matter of personal liberty at stake. In UK, according to a Sugar Tax

Shopper survey, there were not any significant changes in consumer habits after

the introduction of the soft drink levy[12].

11% of shoppers claimed they planned to stop drinking sugary soft drinks prior

to the tax; this number has fallen to just 1% post-tax. The number of people

who said they would continue to buy sugary soft drinks also, grew post-tax,

increasing from 31% in February to 44% in June.

WHO likened the taxation of

sugary drinks to the taxation of tobacco. Malaysia’s experience on using tax as

to curb tobacco use and even alcoholic drinks has led to another issue –

smuggling[13].

Galen CEO Azrul Mohd Khalib said that cigarette price

increases (from sin taxes/excise duties) are a “double-edged sword” as they

reduce consumption among younger smokers who are price-sensitive, but at the

same time drive these users to increase the market share of illicit brands.

According to Azrul, the government lost more than RM4b in tobacco-related tax

revenue in 2017 due to the illicit market. If the price increases arising from

the sugar tax become unbearable, it possible that there will be a demand for

smuggled sugary drinks.

Is a tax on only sugary drinks half-baked?

If the government is intent on imposing a sugar tax, I

think it is worth considering what Hungary has done. In 2011, Hungary introduced

a “public health product tax” on foods and drinks that contain large quantities

of sugar and salt, such as soft drinks, alcoholic beverages, energy drinks,

confectionery, salty snacks and fruit jams. The amount of tax paid is

determined by the units of product bought or sold, and units are measured in

kilograms or litres. According to a brief by WHO, since its introduction in 2011, consumption

of unhealthy food products has decreased concomitantly with the decrease in the

supply and sale of those products[14].

Considering that a regular Malaysian’s diet is high in sugar, salt and fat

(mamaks and fast food), it would be more effective widen the scope of sugar tax

to cover food and drinks with excessive sugar, salt and fat.

Can't have your cake and eat it too

Other than that, I think Malaysia needs to

determine the objective of its sugar tax. Does the government want to increase

revenue or reduce the people’s consumption of sugar? Or should there be a

balance between the two? If the purpose of the tax is to reduce the consumption

of sugar, then the government should not expect to earn a lot of revenue under

this initiative. Otherwise, if people consume sugary/sweetened drinks

excessively, then the government would be able to increase its revenue collection.

However, this will be at the expense of the health budget every year.

Carrot better than the stick

In my view, when it comes to health decisions, it is more beneficial to

encourage, educate and enable rather than punish. Instead of taxing sugary

drinks, I would advocate cheaper healthy drinks as a substitute. For example, sugar-free

drinks could be made cheaper by reducing the margins companies put on them or via

a tax incentive. They cost much less to make but are sold at the same price,

thus making them more profitable. Generally, prices of healthier products are

higher, not because they cost more to produce, but because companies know that

nutritionally-aware consumers are usually more affluent, and therefore willing

to pay a higher price for healthy products[15]. Removing

this “health premium” would make sugar-free drinks cheaper and shift demand in

a healthier direction.

Apart from that, sugar-free/healthier drinks should be made more readily

accessible. For example, fast food outlets do not have much choices besides

frizzy and heavily sweetened drinks. Perhaps alternatives, in the form of fresh

juices, should be given to consumers. In the US, cheaper fruit and vegetable

prices were found to be associated with lower body weight outcomes among both

low-income children and adults, suggesting that subsidies that reduce prices of

fresh produce may be effective in reducing obesity.

The government could also consider setting up

initiatives to encourage companies to voluntarily reduce the content of salt,

sugar and fat in their food and drinks. I must however acknowledge that the introduction

of the excise on sugar drinks is not all that bad for it has spurred the

manufacturers of sugary drinks to take action. Fraser & Neave (F&N)

Malaysia, one of the biggest food and beverage company in Malaysia, has

announced that to mitigate the effects of the sugar tax, it plans to produce

smaller-packs, reformulate and reduce sugar content in its existing offerings

as well as speed up innovations to create healthier products[16]. The

shift seems to be happening at the manufacturers’ side in UK as well[17].

The sugar tax revenue estimates dropped from £500m a year (March 2016) to £275m

per year (November 2017). This is considered as a success as it shows that

companies are reacting to the market and reducing the sugar content of their

products.

Malaysia should not become a nanny state,

where the government tells you what to eat and when to go to bed. The

imposition of a sugar tax, be it for health or revenue purposes, could tip

Malaysia into that unfavorable category. If the government views the sugar tax

as a method to control diabetes and obesity levels, there are more desirable

methods that can be used to encourage Malaysians to lead a healthier lifestyle,

as discussed above. If the government views the sugar tax as method to increase

its revenue, there are different policies that can be used to strengthen

revenue collection and broaden revenue base without disrupting the lives of

Malaysians and containing inflation.

Read more about it here.

Read more about it here.

[1] Stephen, L.,

2018. Obesity in Japan. Can the metabo law prevent it?. [Online] Available at: https://louisestephen.com/2018/02/24/obesity-japan-can-metabo-law-prevent-it/

[Accessed 9 March 2019].

[2] Mohamad

Salleh, N. A., 2018. Taxman leads the charge in South-east Asia's war on sugar.

[Online] Available at: https://www.straitstimes.com/asia/taxman-leads-the-charge-in-south-east-asias-war-on-sugar

[Accessed 9 March 2019].

[3] World Bank,

2017. Diabetes prevalence (% of population ages 20 to 79). [Online] Available at: https://data.worldbank.org/indicator/SH.STA.DIAB.ZS?end=2017&locations=MY-ID-TH-SG-US-PHJP&start=2017&view=bar&year_low_desc=true

[Accessed 19 February 2019].

[4] World Health

Organisation, 2017. Prevalence of obesity among adults, BMI ≥ 30,

age-standardized. [Online] Available at:

http://apps.who.int/gho/data/node.main.A900A?lang=en

[Accessed 21 February 2019].

[5] Economic

Intelligence Unit, 2017. Tackling obesity in ASEAN: Prevalence, impact, and

guidance on interventions. [Online]

Available at: http://www.eiu.com/Handlers/WhitepaperHandler.ashx?fi=Tackling-obesity-in

ASEAN.pdf&mode=wp&campaignid=ObesityInASEAN [Accessed 21 February

2019].

[6] World Health

Organisation, 2017. Taxes on sugary drinks: Why do it? [Online] Available at: https://apps.who.int/iris/bitstream/handle/10665/260253/WHO-NMH-PND-16.5Rev.1-eng.pdf?sequence=1

[Accessed 25 February 2019]

[7] NZ Herald,

National, 2018. Introduce capital gains tax, says Cullen's working group.

[Online] Available at: https://www.newstalkzb.co.nz/news/national/introduce-capital-gains-tax-says-sir-michael-cullens-tax-working-group/

[Accessed 27 February 2019].

[8] Abas, A.,

2019. Customs Dept: Sugar tax for beverages postponed to July 1. [Online] Available at: https://www.nst.com.my/news/government-public-policy/2019/03/466993/customs-dept-sugar-tax-beverages-postponed-july-1

[Accessed 9 March 2019].

[9] Lim, K. G.,

2016. A Review of Adult Obesity Research in Malaysia. Medical Journal of

Malaysia, 71(Supplement 1), pp. 1-19.

[10] Ananth, D.,

2018. Suggestion for "taxes to change bad behaviour" not

well-founded, says tax barrister. [Online] Available at: https://www.davetaxnz.nz/blog/suggestion-for-taxes-to-change-bad-behaviour-not-well-founded-says-tax-barrister

[Accessed 26 February 2019].

[11] Crampton,

E., 2018. Dr Eric Crampton: There's no good reason for a sugar tax in New

Zealand. [Online] Available at: https://www.stuff.co.nz/national/health/101920079/dr-eric-crampton-theres-no-good-reason-for-a-sugar-tax-in-new-zealand

[Accessed 26 February 2019].

[12] Ceylan, A., 2018. Sugar tax has little impact on

consumer behaviour. [Online] Available at: https://www.nielsen.com/uk/en/insights/news/2018/sugar-tax-little-impact-consumer-behaviour.html

[Accessed 25 February 2019].

[13] Rao, M.,

2018. Tackling the rampant smuggling of cigarettes and its black market.

[Online] Available at: https://themalaysianreserve.com/2018/11/02/tackling-the-rampant-smuggling-of-cigarettes-and-its-black-market/

[Accessed 25 February 2019].

[14] Regional

Office for Europe, World Health Organisation, 2015. Good Practice Brief: Public

Health Product Tax in Hungary. [Online]

Available at: http://www.euro.who.int/en/health-topics/Health-systems/health-systems-response-to-ncds/publications/2015/public-health-product-tax-in-hungary-an-example-of-successful-intersectoral-action-using-a-fiscal-tool-to-promote-healthier-food-choices-and-raise-re

[Accessed 27 February 2019].

[15]

Winkler, J. T., 2012. Taxing unhealthy food and drinks to improve health.

[Online] Available at: https://www.bmj.com/content/344/bmj.e2931/rr/585808

[Accessed 27 February 2019].

[16] Rasid, A.

H., 2019. F&N to introduce record number of new products this year to

mitigate sugar tax. [Online] Available

at: https://www.nst.com.my/business/2019/01/453630/fn-introduce-record-number-new-products-year-mitigate-sugar-tax

[Accessed 27 February 2019].

[17] Pym, H.,

2018. Sugar tax is already producing results. [Online] Available at: https://www.bbc.com/news/health-43372295

[Accessed 25 February 2019].

Thank you for sharing this valuable information. Your explanation clearly answers in an understandable way and very helpful! This can give better insights and inspiration for business owners. We would love to see more updates from you on Malaysian SST

ReplyDeleteGoto

ReplyDeletehow much sugar in soft drinks

I should assert barely that its astounding! The blog is informational also always fabricate amazing entitys. sugar balance

ReplyDeleteIf you own a home, for example, your itemized deductions for mortgage interest and property taxes may easily add up to more than the standard deduction.

ReplyDeleteBest tax advisor in London

Merchants profit by simpler business following and buyers profit by simpler installments and progressively exact charging. With a framework this simple, make sure to bring an assigned driver! glass bottles with cork stoppers wholesale

ReplyDeleteI have bookmarked your website because this site contains valuable information in it. I am really happy with articles quality and presentation. Thanks a lot for keeping great stuff. I am very much thankful for this site.

ReplyDeleteTaxation services Pascoe Vale

Really appreciate to the admin for providing the great efforts with unique content. I am waiting for your post again soon.

ReplyDeleteTax Consultants in London

Thanks for the blog loaded with so many information. Stopping by your blog helped me to get what I was looking for. IRS fresh start initiative

ReplyDeleteI think so people are loving this blog as this seems to be a masterpiece as it is amazingly written with the intent to share information and help people in their respective fields how to integrate with fbrYou should write more articles like this to help people. We truly loved it.

ReplyDeletePositive site, where did u come up with the information on this posting?I have read a few of the articles on your website now, and I really like your style. Thanks a million and please keep up the effective work. Reduces Sugar Cravings

ReplyDeletesuperslop

ReplyDeleteหรือ ภาษาไทย บ้านๆ เรียกว่า ซุปเปอร์สล็อต เราคือผู้ให้บริการสล็อตออนไลน์มีตัวเกมสล็อตให้เลือกเล่นจำนวนมากบนมือถืออันดับ 1 ทั้งฟรี

I know your expertise on this. I must say we should have an online discussion on this. Writing only comments will close the discussion straight away! And will restrict the benefits from this information. likvideerimine

ReplyDeleteHello, this is a nicely explained article. Your piece was very informative. I had never heard the issue presented in that light. Thanks for your hard work.

ReplyDeletewebsite design company selangor

corporate identity design services

annual report design agency malaysia

Appreciating the persistence you put into your blog and the detailed information you provide. Keep up the good work.

ReplyDeleteplastic packaging malaysia

custom packaging malaysia

plastic cup malaysia

What to do when you are free? Let’s read.

ReplyDeletejjack in the box menu prices

jack in the box menu and chipotle menu options

Hey, this is a great post, so clear and easy to understand. All your hard work is much appreciated.

ReplyDeletefire extinguisher

fire sprinkler system

ccc malaysia

Thanks for this post. I really enjoy your point of view on this topic. Hope you are doing well.

ReplyDeletelaser hair removal malaysia

scar removal treatment malaysia

Enjoyed reading the article above, the article is very interesting and informative. Thank you and good luck with the upcoming articles.

ReplyDeleteproperty valuation malaysia

urgent cash malaysia

personal loan malaysia

Nice article you shared. Thanks for sharing.

ReplyDeletehttps://www.bluebricks.com.my/loan-rejected-malaysia/

personal loan rejected

https://www.bluebricks.com.my/personal-loan-freelancer-malaysia/

personal loan for freelancer malaysia

Good articles should be shared more often.

ReplyDeleteskin specialist kuala lumpur, skin specialist clinic kuala lumpur, and facial treatment malaysia

Appreciating the persistence you put into your blog and the detailed information you provide. Keep up the good work.

ReplyDeleteice cream container singapore

plastic injection moulding singapore

ice cream tub singapore