by Dave Ananth

Dave Ananth, Senior Tax Counsel with Stace Hammond Lawyers, is

based in Auckland, New Zealand. He is a senior lawyer, a former Magistrate and advocate

in Malaysia before taking up a position with the Inland Revenue Department in

New Zealand as a Prosecutor. He is an expert in taxation and tax policy. He

also writes extensively on direct and indirect tax issues in Malaysia and New

Zealand. He is a consultant for Wolters Kluwer Malaysia. He can be reached at davea@shg.co.nz.

The usage of tax to change “unhealthy behaviour” is not uncommon. Examples

include “sin taxes” on cigarettes and alcohol, tax on high fat food (Denmark)

and a “metabo” law (Japan) which was introduced to overcome obesity through

annual measurement of waist circumference, provision of weight loss classes and

the imposition of fines[1].

Malaysia’s sweet tooth

In August 2018, Damanasara MP Tony Pua floated the idea of a “soda tax”

to kill two birds with one stone – to increase government revenue and encourage

healthy living. A few weeks later, Prime Minister Dr Mahathir Mohamad says the

government is considering implementing a soda tax to encourage healthy living

and reduce sugar consumption as the diabetes rate in Malaysia is very high.

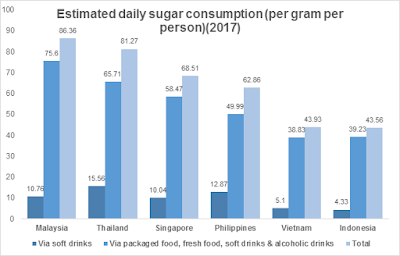

It cannot be denied that Malaysians are eating and

drinking too much sugar. Not just from soft drinks, but from other sweetened

drinks (teh tarik), local kuih (cakes) and biscuits. Per the chart below, the

estimated daily consumption of sugar is the highest among Malaysians[2]

in Southeast Asia (SEA).

It was reported that in 2017, about 16.74% of

adults in Malaysia have diabetes. While it is not the highest in the world

(Malaysia ranks 12), Malaysia still has the highest number of diabetes

sufferers in SEA[3].

It is also worth noting that Malaysia has the highest levels of obesity

sufferers in SEA, at 15.6%. Again, while Malaysia is not the highest in the

world[4],

it is still a cause for concern. Total (direct and indirect) costs of obesity

are highest in Malaysia, amid SEA, where it is estimated to be between 10% and

19% of national healthcare spending[5].